Which local authorities spend public funding with Amazon?

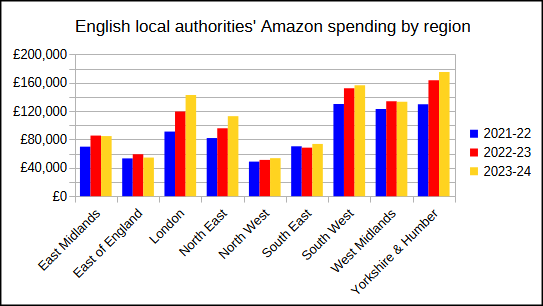

The top three spenders in 2023/24 were:

- Hackney (London): £1.1m

- North Yorkshire Council: £701K

- Greenwich: £452K.

Hackney disclosed that the figure provided included spending with Amazon Web Services (AWS), Amazon’s cloud computing arm. It is unclear whether the North Yorkshire Council’s and Greenwich’s amounts include spending with AWS or not.

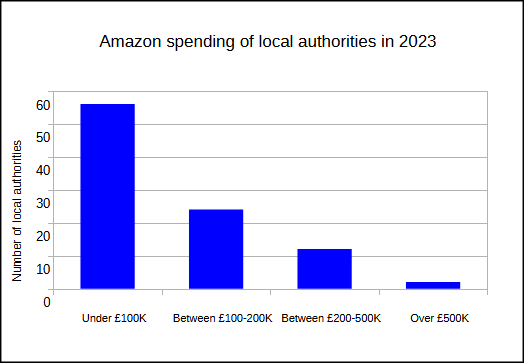

Only two of the 96 responding local authorities didn't spend anything with Amazon in the past three financial years: Sefton Borough Council (Liverpool) and Wandsworth (London). We have contacted both local authorities for comment but we have not heard back from them.

We also contacted Bristol City Council (BCC), a local authority that had seen a steady decrease in its spending with Amazon over the past three years. Almost half of the councillors at BCC represent the Green party and it discussed a motion to “stand up for Responsible Tax Conduct” at the beginning of 2024.

However, when we contacted them, we were told that “Fundamentally there is an issue with the council's ability to lawfully discriminate against suppliers on the basis of us not being in favour of their legal tax arrangements.” We were also told that there is no council policy to reduce spend with Amazon.

Some procurement professionals commented that "Bristol (a city that prides itself on being progressive) City Council’s response is both disappointing and disingenuous". It was suggested that the reasoning is, to an extent, true in respect of cloud services bought from AWS where public procurement processes will have taken place. But they added that there is no valid excuse for notable spend with Amazon in respect of extensive purchase of goods via the Amazon e-marketplace, or the adoption of an Amazon Business account. These were seen as very deliberate or "lazy" options, that actually discriminate against other suppliers who have been denied opportunities to supply.

At Ethical Consumer we have been calling for public sector procurement rules to be changed to clearly permit a company's tax conduct to be taken into account in procurement decisions.

Disappointingly, a new National Procurement Policy Statement published in February 2025 does not specify that publicly funded organisations should opt to procure from companies that pay their fair share of taxes.